by Bob Goulooze

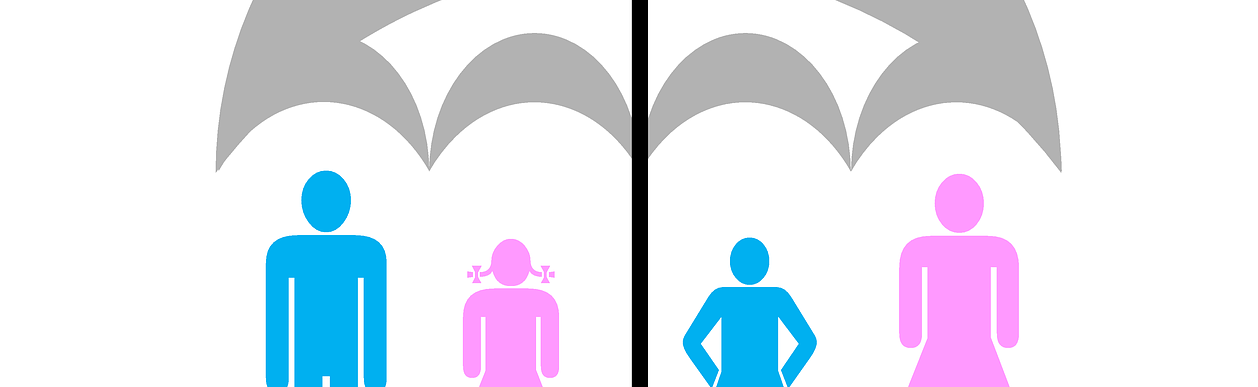

In order to create economies of scale, national airline companies are looking for partners, preferably equal ones, but certainly ones that may complement the current services of the flag carrier. In 2004, Air France (AF) merged with KLM and troubles have arisen since then. AF is the biggest partner in the joint venture with KLM and claimed the lead from day one. Those who are familiar with the way the French work couldn’t believe in the first place that this would be a match made in heaven. The French have the patronage system, which is a social unequal relationship between a powerful and less powerful partner. The powerful ‘patron’ renders favors to the subservient one in return for services, adherence, and homage. You don’t have to be culturally savvy to understand that such a patronage relationship is so un-Dutch, at least being at the receiving end. The Dutch have a more equal culture in which reaching consensus is the bottom line.

Continue reading…