by Andy Scherpenberg

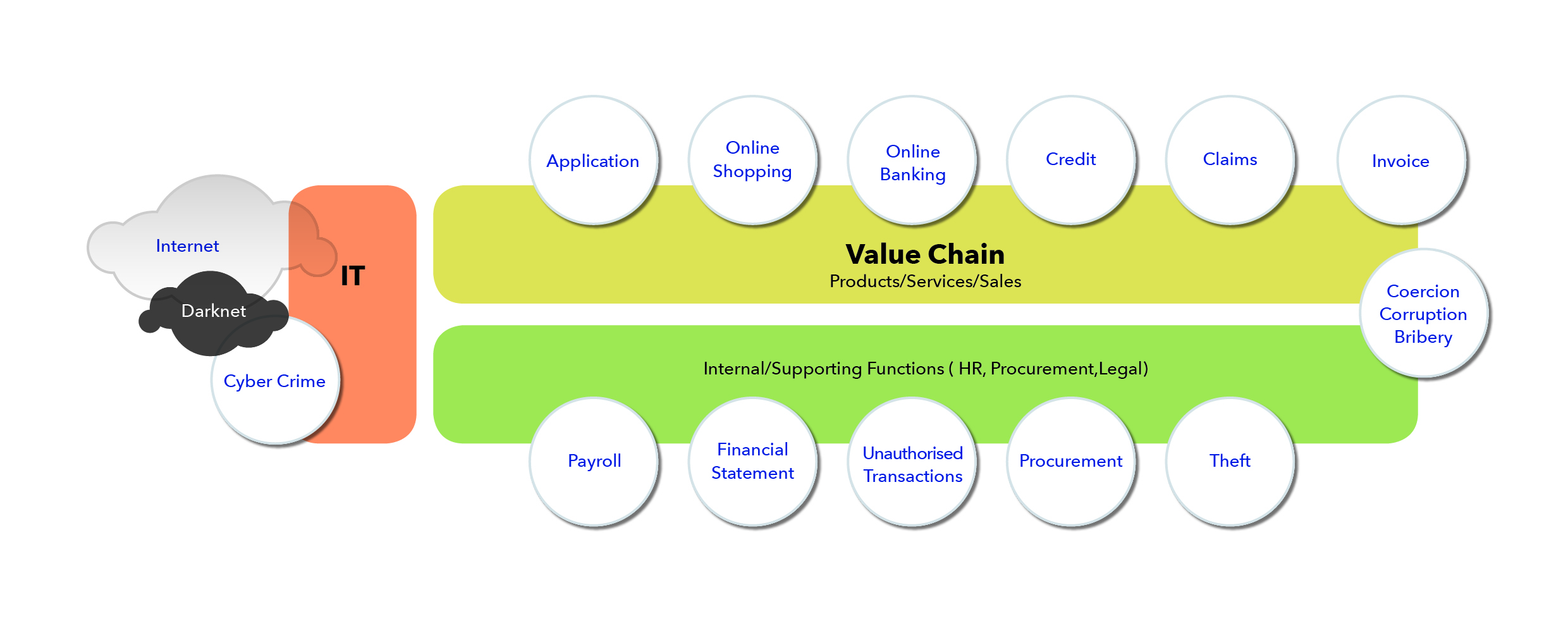

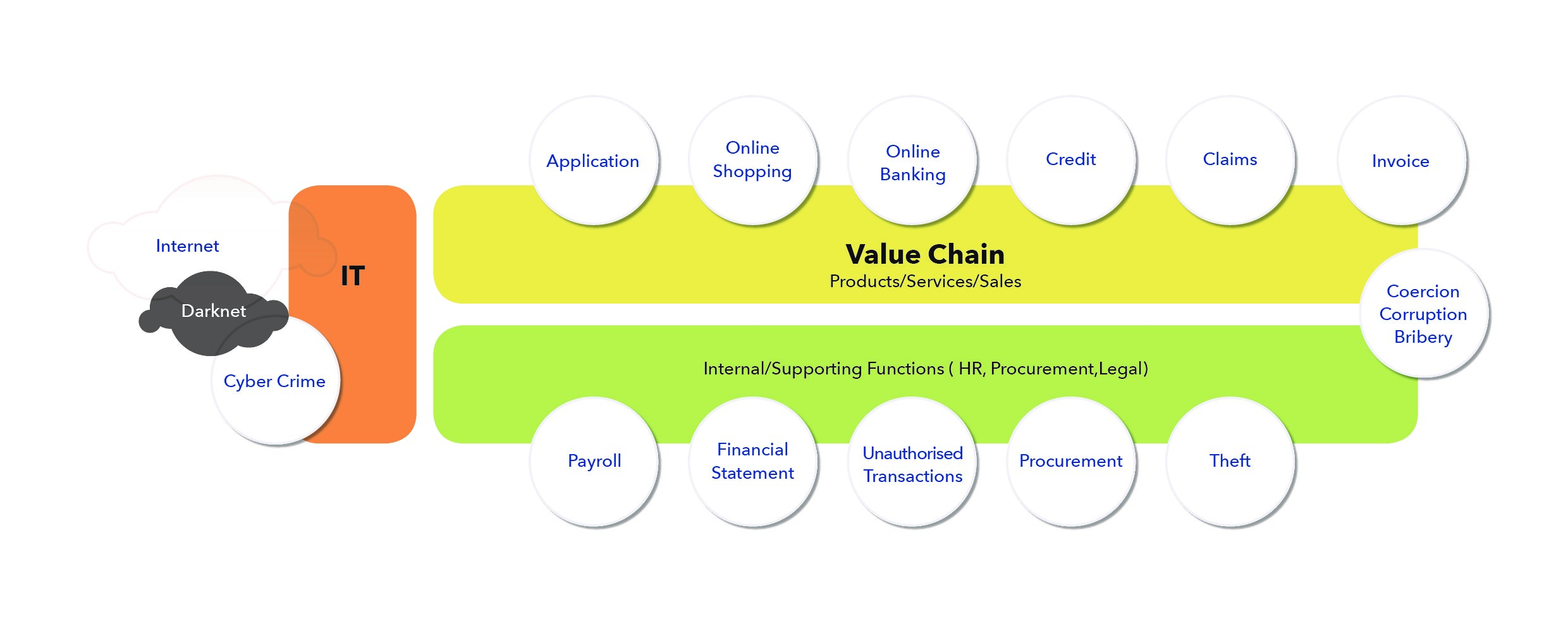

VAT carousels, intentional road collisions to defraud the insurance companies, ‘man in the browser’ technology that intercepts your financial transactions and modifies both amount and account number while you are still seeing the usual transaction screens: fraud has permeated every sector and is taking new forms and shapes. Fraudsters are becoming smarter by the day and they have access to more and more resources. In a previous blog post you could already get a sense if the impressive weaponry that the fraudsters have at their disposal. Continue reading…