by Alex Movchan

We have recently had the pleasure of speaking with Olga Lukashenko who is an Audit Director at Reanda Netherlands. She is an incredibly dedicated finance professional with experience in accounting, auditing and financial management. She also has a proven track record in preparation of consolidated financial statements according to IFRS and GAAP, IFRS-reporting implementation in different accounting systems, as well as auditing and independent assessment of financial and non-financial data. Olga has an impressive international career with in depth knowledge of audit practices. This year is very unusual in terms of the Covid-19 related situation and many Chief Audit Executives struggle to execute the audit plans given travel restrictions, additional limitations of resources and shifting business priorities.

Based on your experience and the successful cases you’re aware of, please share some solutions that might be applied to adjust audit planning in line with shifting business risks and maybe some practical ways out to succeed in the execution of audit engagements in line with annual audit plan in these hard times of travel restrictions and home office work.

Olga Lukashenko : “First of all, I would like to thank you for the interview invitation. It is impressive how quickly we switched to online meetings nowadays. After a few months of lockdown, I am happy to see that our deadlines were hardly influenced by the ‘new life’ during the Covid-19 crisis. On 11 March 2020, the Director General of the World Health Organisation declared the coronavirus a global pandemic. Measures taken by various governments to prevent the virus spread affected the economic activities. The Covid-19 crisis is challenging businesses around the world, including Audit & Assurance practice. Lockdowns, travel restrictions and social distancing are directly impacting our ways of working. The ability to conduct an audit – meet the business, visit sites, interview auditees, walk through processes, check documents, observe and test controls etc., which traditionally has been strongly dependent on physical proximity is currently hindered like never before. At the same time, the Covid-19 crisis has heightened the risks across many organisations, and attending to such risks is also more important than ever.

Access to people, sites and data

When access is restricted due to home working, travel embargoes, unreachable sites and physical distancing, teams are facing unprecedented challenges in delivering their work and keeping contact with the business. There is a number of tools and platforms available. We have tried the following so far:

- Remote meeting and video conferencing to keep the contact within the team, as well as with the business and to perform interviews and walkthroughs. The ‘seeing’ each other on screen is more connecting and enhancing existing relationships as compared to good old-fashioned phone or emails. We do not have any preferences in using MS Teams, Skype, Zoom or WhatsApp calls, but we are trying to find the most secure way for the ‘online meeting’. For some meetings, we have to add an appropriate filter. It depends on whether you would like to add an office background for your call with a client or simply to drink a coffee with your colleague and transfer yourself somewhere to the Alps.

- Data analysis: It enables testing a greater proportion of transactions as opposed to traditional sample testing, gaining efficiency, providing valuable insights and importantly increasing certainty in audit conclusions.

- Using online knowledge, repositories, audit systems, as well as various cloud-based file sharing, collaboration and workshop facilitation tools to help with virtual risk assessments, audit discussions and quality assurance.

Group audit considerations – review of component work papers and travel restrictions

The Institute of Singapore Chartered Accountants has released Audit Guidance Statement 12 on Group Audits – Inaccessibility of Component Auditors’ Work papers and other considerations, which set out guidance for situations where the group engagement team has determined it necessary to review component auditor’s working papers, but is unable to access those work papers due to travel and other restrictions. The ICAEW has also published Considerations for Group Auditors a guide from group auditors with component auditors based in jurisdictions affected by the coronavirus, which by now is pretty much every jurisdiction.

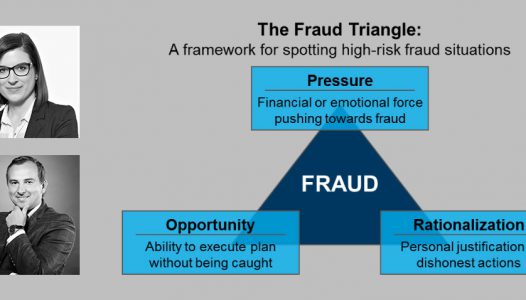

International businesses with a diverse geographical footprint are now affected by travel restrictions and mandatory self-isolation on arrival in many countries. Yet, auditors still need to provide assurance to the respective Audit Committees and Management, especially over material and business-critical operations abroad as well as smaller operations in countries with low transparency and high risks of fraud, corruption and bribery. Depending on the risk profiles and available budgets, it could be considered:

- conducting remote audits using technology as much as currently possible;

- recruiting auditors locally where it makes business sense;

- co-sourcing audit delivery locally, where it is pertinent and cost effective to do so, and in the meantime furlough existing staff who are unable to travel.

Financial Reporting Implications. The auditors have to consider the Financial Reporting Implications, covering the following areas:

- Going concern;

- Reflecting conditions which existed at the balance sheet date;

- Non-adjusting post balance sheet events;

- Director’s report and Annual Report; and

- Potential impacts on 2020 year-ends.

Going concern assumptions

Following the government measures, management of different client have updated their evaluation of its ability to continue as a going concern to incorporate an assessment of the potential impact of Covid-19. This included assessment of the expected disruption on markets, and specifically the client’s operations. While the impact of Covid-19 is uncertain and unquantifiable, a variety of mitigating actions and contingency plans in response to the pandemic have been implemented. In challenging management’s assessment of the impact of Covid-19 on their business, our audit procedures included:

- conducting enquiries with key members of management outside of the finance function, to understand the client’s mitigating actions and contingency plans;

- reviewing board reporting with regard to the expected business impact of the matter;

- reviewing financial statements with regard to the expected impact of the matter;

- accounting implications of the Covid-19 outbreak on the calculation of expected credit losses in accordance with IFRS 9;

- to check the disclosure (i) their accounting policy for determining when a modification is substantial if relevant to an understanding of their financial statements, and (ii) judgements made that have the most significant effect on the amounts recognised in their financial statements;

- assessment of significant increase in credit risk;

- assessment of the going concern assumptions disclosure;

- assessment of the subsequent events disclosure;

- obtaining evidence of the client’s documented pandemic planning, and contingency plans to continue plant operations; and to

- consider the necessity to modify auditor’s report by including an emphasis of matter, other matter paragraph, qualification due to going concern uncertainty.

Events after the balance date. For most entities the crisis emerged after the end of their financial year. Auditors will need to assess whether the disclosures provided by the entity on the impact, both qualitatively and quantitatively, of the Covid-19 outbreak on its activities, financial situation and future economic performance is appropriate in view of the applicable financial reporting framework, and may need to include a related emphasis of matter paragraph in their audit report. Where this is not the case, auditors may need to modify their audit reports accordingly.

Reporting and Communication. Auditors are reminded to pay appropriate attention to assessing whether the description of the entity’s financial position, the principal risks and uncertainties that it faces and its likely future development is consistent with the knowledge they have obtained as part of their audit work. Auditors are reminded that it is important that they communicate timely and appropriately with the entity’s management about the impact of the Covid-19 outbreak on their audit work as well as on the entity and its financial statements. Where appropriate, auditors may decide to include a key audit matter in their audit report. They are also reminded that the applicable standards, the Audit Regulation (EU) N°537/2014 of the European Parliament and of the Council of 16 April 2014, or local requirements may require that they report these matters to the relevant authorities or other bodies outside of the entity.

Audit Plan. Existing Audit Plans may no longer reflect the risk profile of their business as altered by the crisis. In response, performing new risk assessments and engaging with the business to revise or even perhaps where necessary, recreate the Audit Plan, are advisable. Fortunately for most December 2019 year ends, the impact of the outbreak on inventory count attendance is limited. However, it is important for those audits with reporting deadlines in the next few months that the auditor considers the impact of travel and other restrictions on their ability to attend inventory counts in accordance with ISA 501. Where physical attendance is not possible, auditor’s may consider whether there are alternative means of “virtual attendance” (e.g. drone, video etc.) or whether alternative procedures can be undertaken. Where physical inventory count attendance or alternative procedures are not possible, the auditor will consider the impact on the audit report.

As a summary, it’s worth mentioning that probably all of us are waiting to get back to doing business as usual, but with borders still being closed and continued uncertainty, we should constantly reassess if existing business practices and also audit approach used is the most appropriate given the circumstances. It is challenging and rather an ongoing process, not a one off exercise, but organisations that would be able to show higher agility and adapt to the ‘new normal’ faster would be able to gain market share during the times of uncertainty that we are facing nowadays.”

The author, Alex Movchan CIA CICA CFE is the President of the Institute for Internal Controls (Ukraine and Belarus chapter). He is also currently the Head of Internal Controls in a global medical company.