by Elfriede Sixt

Recently, the European Funds Recovery Initiative (EFRI) was joined by a group of more than 30 European1 people who fell victim to highly sophisticated and devious “boiler room” scams, which are currently coming from China and especially from its financial center, Hong Kong. The scammers routinely abuse the reputation of this Asian financial metropolis. By doing some research on this kind of scams, we have come to learn that with being a wonderful gateway between mainland China and the rest of the world and with being a known prospering investment place for Chinese technology companies, Hong Kong has clearly set the perfect grounds for immense fraud activities at the expense of unsuspecting Europeans for many years now. Evidently, hundreds, if not thousands, of Europeans have been transferring millions, if not billions, of their life-time savings to Hong Kong banks, trusted so it seemed in a safe and developed banking environment. Media reports about this kind of fraud occurring in Hong Kong date back to 20151.

The ease of forming companies in Hong Kong, the easy access to mainland Chinese people who sell their identities, and the ease of account openings at reputable Hong Kong banks are obviously facilitators for this type of fraud scheme. However, the criminals would hardly have such success if they could not take advantage of the negligent handling of the money laundering law and compliance rules by the involved Hong Kong banks.

In recent years, the financial damage caused in Europe by this fraud scheme is estimated to be beyond EUR 100 million. European countries affected by this financial fraud are Austria, Belgium, Germany, Italy, the Netherlands and Switzerland.

Hong Kong – the fraud “epicenter and platform”

Lured by fancy brokerage websites2 and allegedly highly experienced brokers presenting compelling investment opportunities, unsuspecting European retail investors deposit material amounts with Hong Kong based trading companies for investments in promising Asian technology companies.

The role of Hong Kong company builders in this kind of investment fraud

According to our investigations, Hong Kong company builders are used:

- to administer the fake promising Chinese “technology companies” (the investment opportunities) as well as

- to set up and to administer the fake “trading companies” that are supposed to handle the acquisition of the shares in the promising Hong Kong investment opportunities.

Non-active shell companies are marketed as promising Chinese technology companies (investment opportunities)

Shell companies, registered years ago, get redressed as promising technology companies with upcoming IPOS or shares of these companies being on sale. Sophisticated websites and fake reviews in reputable online media pretend to look like a successful technology company operating in Hong Kong.

Some examples can be seen in the table:

All trading companies used to obtaining the funds for the investment from the European retail investors show the following characteristics:

- The majority of these trading companies are newly founded. The setup as well as the registration process was done by only a limited number of Hong Kong company builders1.

- More or less all of them have their registered offices in the relevant Hong Kong company builders’ offices.

- The registered managing directors and nominee shareholders are mainland Chinese with no residency in Hong Kong.

- All these trading companies have no employees.

- The business purpose as registered in the commercial register of Hong Kong does not match with the obvious activities of these trading companies – exclusively acting as illegal payment service providers.

By now a majority of the 55 trading companies used for this fraud scheme have been all but dissolved. All bank accounts were emptied, and the money was sent offshore. Hong Kong’s status as an international financial center, the relative ease of company formation and its geographic location evidently expose it to the misuse of legal persons.

The role of the Hong Kong bankers

Hong Kong is an active member of international AML/CFT organisations, having been a member of the Financial Action Task Force (FATF) since 1991 and a founding member of the Asia/Pacific Group on money laundering (APG) since 1997. With Hong Kong being one of the largest international financial centers with a highly externally oriented economy, it is immensely attractive for criminals seeking to hide or move funds.

More astonishing is that during the past, more than three years worth of European fraud victims got instructed to send their funds to Hong Kong trading companies, which will deal with the order to handle the investment of the European investors – with some of the biggest and most respectable banks of the world.

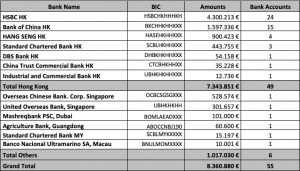

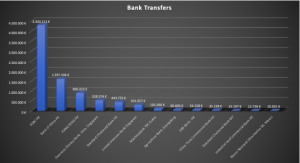

In total, more than 30 European victims – all registered with EFRI – transferred more than 8 Mio EUR to 55 Hong Kong registered trading companies with 49 different Hong Kong bank accounts and 6 bank accounts in other jurisdictions as shown in the table and graph:

Moreover, Hong Kong banks do not carry out proper Know Your Customers Due Diligence and do not monitor for suspicious transactions as required by the FATF KYC/CFT standards.

This is in particular delicate for the financial institutions of Hong Kong, as according to an article of South China Morning Post dated 18th of January 2015, Hong Kong’s banks were facilitating an almost identical boiler room money laundering scheme. 1

As that article states: “Boiler room accounts generally see a high frequency of small deposits coming in from various countries. Money is then removed from accounts in cash withdrawals. Such transaction patterns could indicate a money laundering technique called “smurfing. This is where the customer due diligence comes in. The bank should check what type of business the customer engages in before opening the account and then continue to monitor the customer’s business,” said Deane.

Questions should arise on why Hong Kong’s financial institutions have not learned their lessons since then. The ease of forming companies in Hong Kong, the access to mainland Chinese who sell their identities and the ease of account openings at reputable Hong Kong banks obviously still remain facilitators for such fraud schemes. It may be speculated whether there are deficiencies in Hong Kong’s existing regulations or if the financial institutions in Hong Kong willingly do not implement proper KYC processes and online monitoring in order to foster their business volume. However, this comes with a substantial price tag, which can and has caused a negative impact on the reputation and confidence in Hong Kong as a reputable financial center as well as a devastating impact on the European victims and other victims worldwide!

Alarming hints that collusion took place between the bankers and the scammers are as follows:

- Serial opening up of bank accounts for shell companies organised by Hong Kong company builders

- Material wire transfer amounts (some > EUR 200.000) from European retail investors should have raised red flags within the banks.

- Some transfers made by the victims had incomplete bank account numbers, however the transactions were still completed without any inquiries by the receiving banks.

The total size of the fraud

The fraud experience has tremendous social impacts on the defrauded European investors, who have sent their hard and honestly earned funds to one of the supposedly best regulated and supervised financial markets worldwide. New victims of these Asia investment fraud schemes are showing up on a daily basis and are raising the total number of losses. The number of victims must be tremendous and the amounts transferred most probably reach into the three millions. Fact based estimations indicate that hundreds, if not thousands of victims in Europe, have been effected.

Complaint filings

The victims have alerted the Hong Kong supervisory authorities, the Hong Kong criminal authorities as well as the compliance departments of the banks involved. Criminal complaints against the scammers and the banks involved have been filed in the home jurisdictions of the European victims as well as in Hong Kong and now, in Singapore as well.

Still, it remains to be seen whether the ongoing investigations will indeed result in any outcome, which provides support and hope for many victims in Europe. In particular, it will be interesting to see whether the banks acknowledge any responsibility. Regretfully, the groups of victims need to come to terms with the fact that Hong Kong’s banks are categorically denying any responsibility thus far.

Promise of a reward

As the victims are eager to get ahold of the scammers and to find out more about the role the banks played, they are prepared to pay a considerable reward of up to USD 150.000 for any whistleblowers that are willing to hand over any valuable information.

* (1) Hong Kong banks caught up in ‘boiler room’ money laundering schemes | South China Morning Post (scmp.com) written by Benjamin Robertson on 28 January 2015.

* (2) The role of the ‘company builders in Hong Kong’

Only a limited number of Hong Kong company builders were identified, which registered the great majority of the aforementioned trading companies, which also act as company secretary of these shell companies and even provide the official address in Hong Kong for these shell companies. Two names of these company builders stand out: BSIDA International Business (HK) Limited and Hong Kong Ten Yan Business Secretary Limited, only registered on the 12th of January 2018.

The author, Elfriede Sixt ist Wirtschaftsprüferin, Steuerberaterin. Sie absolvierte bereits im Jahre 1993 die Prüfung zum US CPA und war in der Folge jahrelang als Gesellschafterin und Geschäftsführerin von Ernst & Young Wien tätig. Frau Mag. Sixt beschäftigt sich seit vielen Jahren mit dem Thema FinTech. Sie beschäftigt sich mit Themen wie Crowdfunding und publiziert zu Themen aus diesem Bereich (beispielsweise das Buch “Schwarmökonomie und Crowdfunding” im SpringerGabler Verlag) und Kryptowährungen. Im September 2016 wird ihr zweites Buch: Bitcoin und andere dezentrale Transaktionssysteme /Blockchains als Basis einer Kryptoökonomie veröffentlicht. Seit 2018 beschäftigt sich Frau Mag. Sixt mit Cybercrime, sie gründete den Verein EFRI – European Funds Recovery Initiative, der sich mit Cyber-Betrug an Konsumenten beschäftigt und adressiert dabei auch die Problematik der Geldwäscheproblematik bei europäischen Finanzdienstleistern.

Pingback: Defrauding Europe and the West? How Hong Kong banks facilitate the defrauding of thousands of unsuspecting Europeans |