The European Banking Authority (EBA) published its tenth report on risks and vulnerabilities in the EU banking sector. The report is accompanied by the 2017 EU-wide transparency exercise, which provides key data in a comparable and accessible format for 132 banks across the EU. The data shows further resilience in the EU banking sector amid a benign macroeconomic and financial environment, with an additional strengthening of the capital position, an improvement of asset quality and a slight increase of profitability. However, further progress on NPLs is needed whilst the long-term sustainability of prevailing business models remains a challenge. The importance of robust data management and IT and operational resilience is also a priority.

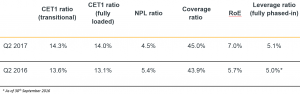

EU banking sector solvency has continued to strengthen, albeit at a slower pace. The CET1 ratio1 stood at 14.3% as of June 2017, up by 70 bps with respect to June 2016 level. The trend is similar for the fully-loaded CET1 ratio, which reached 14%. The slight increase of capital ratios has been mainly driven by a reduction of the denominator, with banks decreasing their risk exposure amount, markedly for credit risk.

The NPL ratio of EU banks has decreased from 5.4% (as of June 2016) to 4.5%, due to the decline of NPLs, reflecting progress made by EU banks to clean-up their balance sheet. However, around one-third of EU jurisdictions have NPL ratios above 10% and the level of NPLs still remains at a very high historical level (EUR 893Bn). EU area coverage ratio increased to 45% with a high dispersion among countries. EU banks total assets decreased by 6.3% between June 2016 and June 2017. The decline has been driven by the reduction of derivatives exposures and debt securities, while banks have continued to increase loans volume.

Profitability has cautiously improved

Profitability has cautiously improved supported by the benign environment but still remains a key challenge for the EU banking sector. As of June 2017, the average return on equity (RoE) stood at 7.0%, up by 130 bps year on year, its highest level since 2014. This upward trend is mainly explained by a decrease in impairments, an increase of fees and commissions and an increase of trading profits. However, dispersion across countries is still high. The average RoE has remained below the cost of equity and many banks are still struggling to generate sufficient margins through their traditional lending activity in a context of low rate environment and flat yield curves.

Bank funding markets have been characterised by stable conditions in the first three quarters of 2017 amid low volatility. While accommodative monetary policy stances and central banks’ asset purchase programmes have supported low funding costs, overall issuance volumes of unsecured and secured debt decreased in the first three quarters of 2017 compared to 2016.

New and high risks have emerged

In the fast-changing environment, new and high risks have emerged, which cyber and data security among the most challenging ones for the EU banking sector. In addition, risks posed by cyberattacks, their volume and sophistication are unabatedly high. While banking operations have become increasingly dependent on IT platforms, cost pressures and operational challenges have contributed to an increasing reliance on third party service providers that a range of IT services and data are outsourced to.

Source: http://www.eba.europa.eu

EBA sees a more resilient EU banking sector but challenges remain

27 November 2017