The European Securities and Markets Authority (ESMA), the EU securities markets regulator, recently published its second risk dashboard for 2020 which sees a continued risk of decoupling between asset valuations and economic fundamentals. During the third quarter of 2020, EU financial markets have continued their recovery and equity market valuations have edged up further. There are increasing signs of strong geographical and sectorial differentiation across financial markets with fixed income markets seeing large-scale valuation increases across various segments such as emerging markets, investment grade and high yield. Credit rating downgrades have been slowing and investment funds recorded inflows across asset classes, especially for bond funds.

These developments, taken together, highlight the ongoing risk of decoupling between asset valuations and economic fundamentals. So, the potential for a sudden reversal in investor’s risk assessment is the key risk currently seen for EU financial markets and so ESMA maintains its risk assessment.

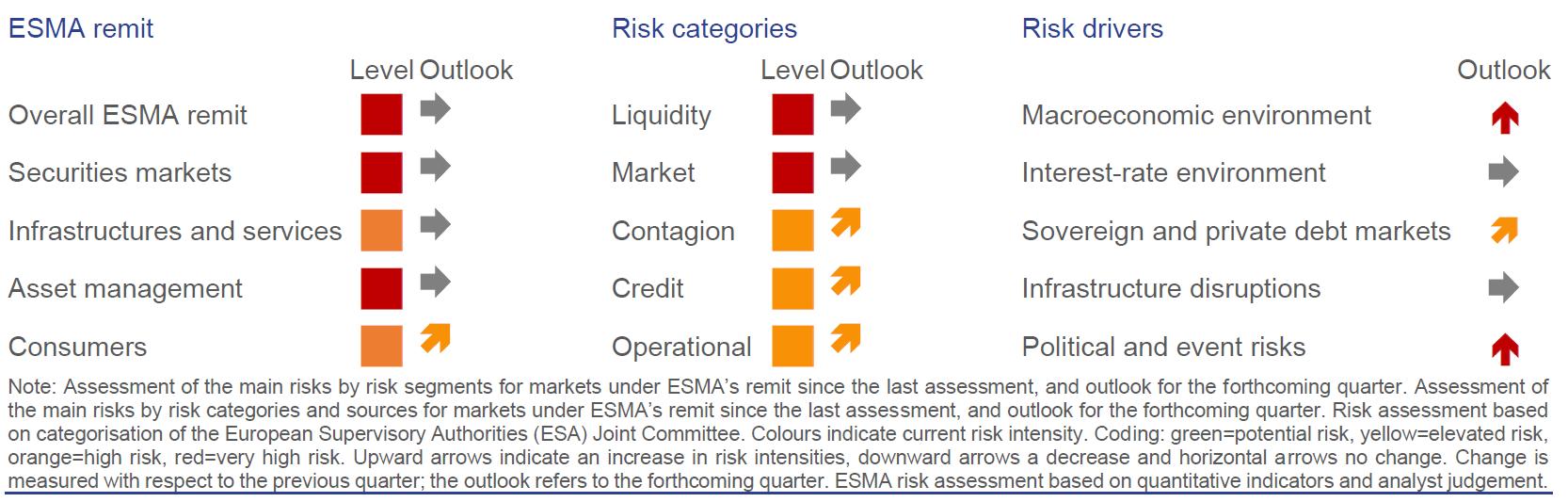

Looking ahead, ESMA sees a prolonged period of risk to institutional and retail investors of further, possibly significant, market corrections and see very high risks across the whole of ESMA’s remit. The extent to which these risks will further materialise will critically depend on three drivers:

- the economic impact of the pandemic;

- market expectations on monetary and fiscal support measures; and

- any occurrence of additional external events in an already fragile global environment

The full report can be found here: https://www.esma.europa.eu/sites/default/files/library/esma50-165-1371_risk_dashboard_no_2_2020.pdf