by Jérôme Bryssinck

The agency responsible for combating carousel fraud in Belgium is the Special Tax Inspectorate (ISI), a division of Belgium’s Federal Public Service Finance. Yannic Hulot, ISI Director, recently explained how carousel fraud has been nearly eradicated in Belgium – and how a similar system could be implemented across Europe to get rid of VAT carousel fraud in the broader region.

Carousel fraud is the theft of value-added tax (VAT) from the government by a network of conspirators (typically organized crime rings). This high-return, hard-to-prove form of tax fraud exploits the weaknesses of the VAT system. It can take many forms, including this common scenario: the first criminal link in the chain sells goods to a conspirator in another country in a tax-free, business-to-business sale. The buyer then sells the goods to another conspirator and collects VAT, with no intention of paying it to the government. The goods are eventually sold tax-free to a conspirator in another country (often the original conspirator), and the seller requests a refund from the government for the VAT it paid on the purchase. This cycle can be repeated multiple times, with huge amounts of VAT being accumulated and misappropriated. This phenomenon continues to grow throughout Europe, where VAT losses are estimated at nearly 100 billion euros (US$132 billion) per year (a number which includes carousels, irregularities, errors and classic fraud).

In Belgium, however, the problem of carousel fraud is under control thanks to an advanced analytics technique called the hybrid detection model from SAS. This innovative method uses multiple analytical techniques to expose even the hardest to find fraudsters. With this approach, the Belgian government saves nearly 1 billion euros each year. In 2002, losses in Belgium from VAT fraud amounted to 1.1 billion euros. In 2012, these losses were a negligible 18.5 million euros, representing a reduction of 98 percent.

Can you tell us about the Special Tax Inspectorate and the types of fraud you investigate?

Yannic Hulot : “Our core business is to investigate organized and serious fraud with complex mechanisms and often with an international dimension. If we say international and complex, it also means networks that we need to analyze in depth. We need fairly advanced risk analysis, and our methods are not methods of mass detection. The ordinary tax administration will select 20,000 cases per year. This is not our situation.

We’re really looking for the very essence of the fraud – for example, someone who has certain characteristics, is known for other acts, for whom we received information from abroad, has put into place a company, and engages in transactions that are not declared. So it takes a bundle of elements to identify. Even if these characterizations are well-defined, the difficulty remains in managing and verifying this information. So we are facing huge amounts of information, still increasing due to emerging events like the European Savings Directive and directives for the cooperation with foreign countries. All this information requires the right tools to manage and analyze it.”

Can you explain the magnitude of VAT carousel fraud?

Yannic Hulot : “Carousel fraud is a mechanism for VAT fraud that can take many forms of different complexity. The schemes involve at least two member countries of the European Union, and increasingly countries outside the European Union are used. In Europe, VAT fraud represents huge sums. The VAT gap is estimated at nearly 100 billion euros per year. One-third of this amount can be attributed to missing traders intracommunity fraud [a form of carousel fraud that claims tax refunds for an unidentified or missing trader somewhere in the export chain]. The effort put in place by the government to fight fraud varies from country to country. The major difficulty is to find the fraudulent transactions quickly in a huge number of transactions. One company in 10,000 participates in these fraudulent transactions, and there are hundreds of millions of transactions within the European Union annually.”

The problem of VAT carousels is now under control in Belgium. How has this been achieved?

Yannic Hulot : “The main thing that has helped us eradicate VAT carousels in Belgium is risk analysis using advanced analytics. This allows us to quickly identify companies at risk so we can take actions before significant damage is created. And when we know that a 100 million euro case does not require more work than a 1 million euro case, we will pick the 100 million case – that’s obvious. With the SAS hybrid detection model, we really have the tools that are in line with our needs (see sidebar, page 29). The results are so good that we can now restart some old projects done with traditional techniques using this innovative network approach as well. The success was such that the FPS Finance, which employs 24,000 people, increased the number of ISI specialists working under Secretary of State for Fraud Prevention John Crombez from 500 to 600. All “fraud hunters” now benefit from this new optimized data mining.”

Social network analysis, a technique that investigates the connections in a network, is used in the hybrid detection model. Is it an adequate tool for the detection of VAT carousels?

Yannic Hulot : “A VAT carousel is nothing more than a network. And for that social network analysis is the perfect tool. With the amount of data we have from intracommunity transactions, company data, unstructured data, etc., we have a cluster of data that is totally unreadable because of the large number of links. The challenge is to extract from this chaos the data that is relevant. This is exactly what we can do with social network analysis and other methods of the hybrid detection model. But key in all this is to also combine business knowledge during the analysis.”

Is this approach applied to all companies or is it limited to areas at risk?

Yannic Hulot : “Another advantage is that it is a holistic approach and not confined to one area. We focus on certain transaction profiles rather than on particular sectors. We may be interested in electronics, carbon, etc. It is not limited either to specific types of transactions. We do not specifically focus on the supply of goods or services. We really develop a comprehensive approach, which is very important. When the approach is fragmented, we might say that we only focus on red cars, for example. This way, the fraudster can change goods or countries and our approach remains valid.”

What is the current situation for the rest of Europe?

Yannic Hulot : “The situation varies greatly from one country to another. European taxpayers lose billions of euros and this is not widely known. Some member states, and in particular the large countries, have difficulties to manage this mass of information. A solution such as the hybrid detection model is the answer to these problems. It allows you to view the essential, to prioritize cases and then to allocate resources. Today, in the 28 EU member states, the data available for analysis of carousels is the same. This means that the Belgian experience is completely transferable.”

So we can dream that one day there will be a common approach at the European level?

Yannic Hulot : “A common analysis is the ideal solution for greater efficiency. The current problem is that some member states consider it a loss of sovereignty to entrust the analysis to others. This centralized analysis could be entrusted to Eurofisc, which is already well-structured and has a lot of business knowledge. A common cross-border analysis would make it possible for governments to save enormous amounts. It’s an important issue for citizens. We are aware of losing tens of billions of euros every year through fraud carousels perpetrated by criminal organizations, while we have a solution at our disposal, a proven technical solution. Not creating the conditions to implement this solution in this difficult budgetary period would be almost criminal.”

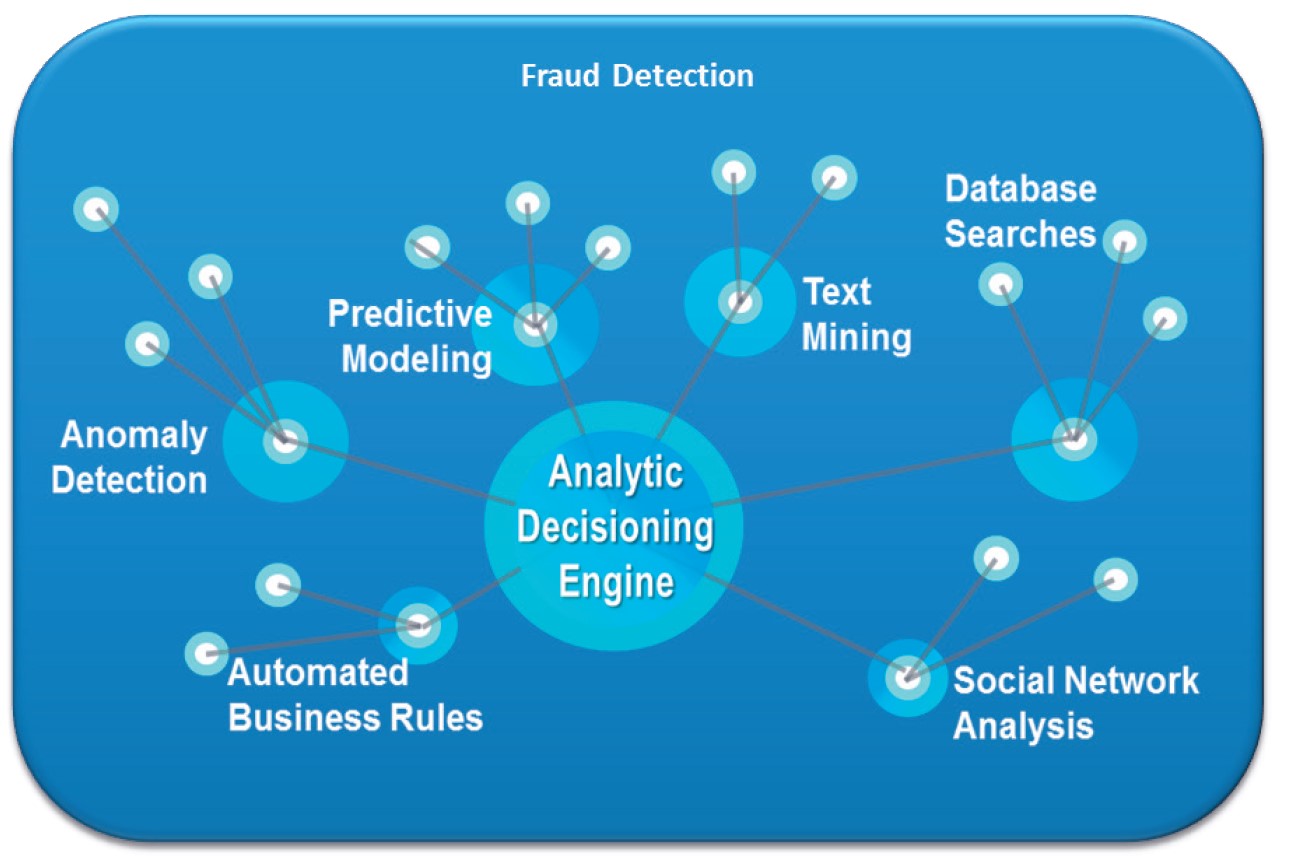

Hybrid Detection Model

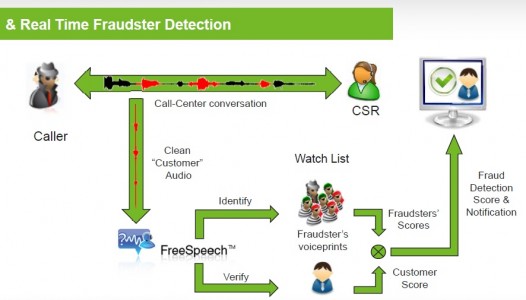

VAT carousel fraud is one of the most sophisticated fraud types faced by tax authorities, which is why it requires a comprehensive analytics platform. It is only through combining different analytical techniques that this type of fraud can be automatically uncovered at acceptable rates.

The author, Jérôme Bryssinck is Director of Government Fraud Solutions, EMEA & AP – Advanced Analytics Business Unit.