In his speech Klaas Knot, President of De Nederlandsche Bank (DNB), talks about the importance of investing in the European economy: investing is the keydriver of future economic growth. He also points out the challenges like climate change. He will do so by addressing three main questions: first, is euro area investment currently too low? Secondly, focus on business investment, and examine what its drivers are. Lastly, he will give his view on how public investment can be tailored to contribute to sustainable economic growth.

Investment is a key driver of future economic growth, and is therefore vital to the continuing expansion of the European economy. Important challenges like investment in human capital and climate change call for substantial private and public investment.

Question1: is euro area investment too low?

Looking at the following figure, we see the development of real investment and its components in the euro area. The yellow line represents the level of real total investment. As you can see, total investment started to recover in early 2013. This was after a period of substantial contraction during the financial crisis and its aftermath. However, it has not yet recovered to pre-crisis levels, despite the unprecedentedly favorable financing conditions.oes th Dat mean euro area real investment is too low? That depends on the type of investment we consider. It also depends on the benchmark used for comparison. I’ll elaborate both these points.

Firstly, total investment growth masks the heterogeneous development of its individual components. These have different implications for the future growth potential of an economy. (…)

Secondly, the diagnosis of whether investment has been low, also depends on the benchmark used. Usual benchmarks include comparisons with past investment growth rates, pre-crisis investment levels, or developments of other macro-economic variables such as GDP.

Although it is not a priori clear which benchmark to use, in the following figure we compare the development of business investment to that of GDP. The dark blue line on the right-hand-side shows the ratio of euro area real business investment to real GDP. This has now surpassed the average observed since the early 2000s, represented by the grey line. However, it is still clearly below its pre-crisis peak. The recovery of the real total investment to real GDP ratio, shown by the yellow line on the left-hand-side, has clearly been more protracted.

When discussing the dynamics of investment, we also have to consider the measurement issues around investment. The structure of the euro area economy has been shifting towards the services sector. Consequently, the nature of investment has been changing, with a notable increase in expenditure on intangibles such as design, patents, branding, and employee-training. This has implications for measuring investment, as intangible assets are only partially included in the official statistics. For example, in last year’s winter forecast report, the European Commission showed that the inclusion of intangibles not currently classified as investment, would more than double the share of intangible investment in business sector gross value added.

So what’s the diagnosis based on this data? Is the glass half full or half empty? The above figure suggest the glass is half full, as business investment has been recovering and reached pre-crisis levels. But we should also be wary of signals that suggest the glass might be half empty. Given the ample cash holdings of non-financial corporations, and very favorable financing conditions, one would expect investment growth to have accelerated even further. To understand why investment growth has thus been weaker, I’ll turn to the second question.

Question 2: What has been driving the observed developments in euro area business investment (or why is investment growth not accelerating?)

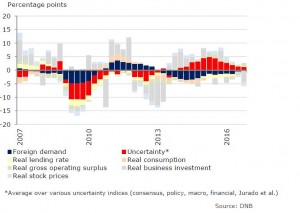

(…) Let’s look at the following figure. It shows a historical shock decomposition for the Netherlands based on a Vector Auto Regression analysis, or VAR. We can see that business investment growth was largely driven by uncertainty shocks and foreign demand shocks, represented by the red and the blue bars, respectively. Uncertainty is measured here as an average of various uncertainty indices. It has had a positive impact on business investment since 2013. Foreign demand has had a negative impact on real business investment over that same period. These results therefore suggest foreign demand is the main factor still weighing on investment growth.

However, this probably doesn’t reveal the whole picture. That’s because macro-data hide important heterogeneity across firms. (…)

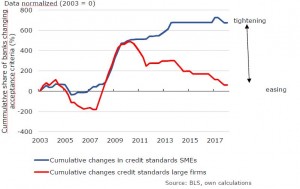

The following figure shows how credit standards already started to ease in 2010 for large firms in the Netherlands, while they continued to tighten for SMEs until 2014 and remained tight thereafter. A 2017 study by Gopinath and others reveals that reallocating funds towards large firms may have unintended consequences. The study shows that large firms attract more funding because they have higher net worth, but are not necessarily more productive. Based on data from Spain, this study explains a significant fraction of the observed decline in total factor productivity, relative to its efficient level in the run up to the crisis.

So, while I can’t really offer any definite answer to the question of why investment growth has been subdued, the evidence we’ve seen points at two issues in my opinion: foreign demand and weak balance sheets. While weak balance sheets underline the financial cycle view, it’s still unclear why foreign demand is low. It would be interesting to hear your thoughts on this during the panel discussion.

Question 3: contribution of public investment?

The last question I want to address is how public investment can contribute to sustainable growth. The decline in public investment and current low interest rate environment, have prompted calls to increase public investment as a way to raise potential output. In my view, public investment should be considered when there is a positive social cost-benefit analysis and when private actors fail to achieve desired outcomes. Furthermore, public debt levels are still high in the aftermath of the sovereign debt crisis. (…)

Meeting the Paris climate goals will also require substantial private investment. Governments should therefore not only make investments themselves, but also pave the way for necessary conditions for private investment. An important step would be to introduce more adequate carbon pricing. This would provide better financial incentives for sustainable private investments. This also calls for pursuing a credible path towards a carbon-neutral economy that allows private actors to gradually adjust their investments. And finally, providing necessary conditions also includes ensuring financial regulation does not lead to unwanted side-effects. The FSB is currently looking into whether financial regulations are hampering private sustainable investments.

Conclusion

(…) There are important challenges ahead, which I believe call for substantial private and public investment. I’ve mentioned human capital and climate change, but there are certainly more. I would be curious to hear your views.

So I look forward to fruitful and constructive discussions today. I trust the knowledge we share will help improve our understanding of recent investment dynamics in Europe. And that it will help shape our response to these challenges we face.

Summary of the Speech by Klaas Knot at the EIB’s Annual Economics Conference: ‘Investment and Investment Finance’. You can read the full version on the website of the DNB.

Source: https://www.dnb.nl/

Investment and investment finance in Europe

24 November 2017