by Ahsan Habib

Canada has become a well-known target, even a magnet, for money laundering. Ironically once a Canadian has the legal right of ownership, the law firmly protects that right. For that reason laundered money in Canada is much more valuable than dirty money elsewhere. And that is why money launderers are ready to pay well over asking for high-priced real estate, where multimillion-dollar blocks of cash can be cleansed in a single deal. The defining issue of our times must be who will stop these criminal predators from selling opioid, laundering the proceeds, buying up real estate and violating every conceivable aspect of Canadian sovereignty and the Criminal Code. Let’s go deeper into the ‘Rabbit Hole’…..

Escrow accounts are being used in real estate transactions, specifically for the sale of a house. There are no significant regulatory obligations imposed on title or escrow providers (or on attorneys handling transactions) to validate the origin of funds coming through a direct wire from an offshore banking account.

Real estate business and Shell Companies: Snow Washing ?

The term ‘Snow Washing’ is used when it comes to talk about tax evasion and money laundering in Canada. It refers to hiding illegitimate financial transactions often for purposes of tax evasion. Some tax advisers around the world are touting shell companies in Canada to help mask a client’s assets and business dealings. Once the company is formed, banks or other parties in other countries are going to presume that it’s legitimate because it’s Canadian — pure as the driven snow of the Great White North … they are trying to pretend that it’s Canadian when it’s really not. Snow Washing becomes more evident when we come across reports on foreign students with no known income buying homes worth millions of dollars in Vancouver.

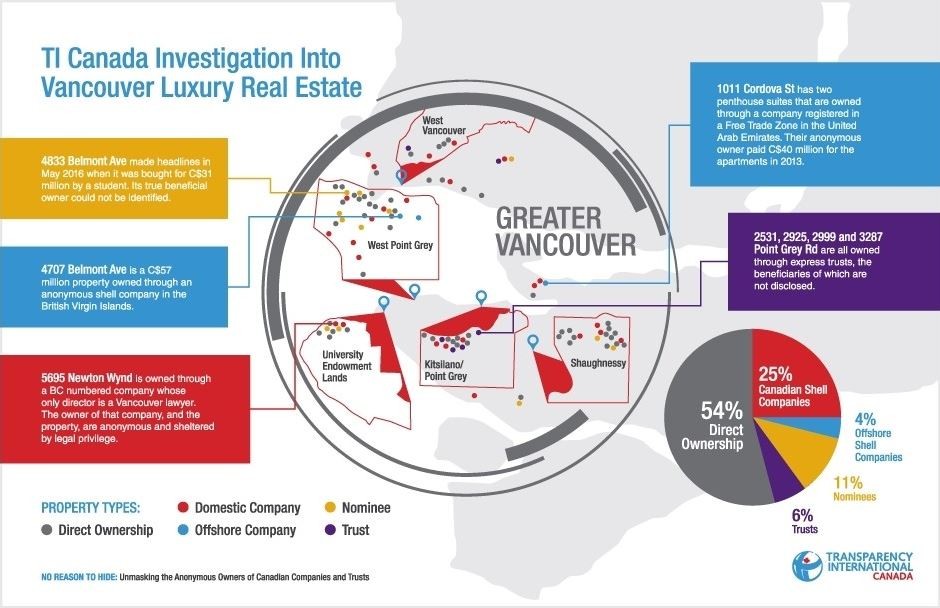

Vancouver : City under scrutiny

Vancouver has become a hub for dirty money, tax evasion, and a place to park foreign cash of unknown origin. Casinos for years have been accepting millions in cash often stuffed into suitcases and most recently, a grey market has been developed in Vancouver-to-China luxury car exports that sent millions of dollars in sales-tax refunds to overseas buyers. Millions of dollars are being laundered through Lower Mainland casinos. The amount of money being laundered in British Columbia is more than anyone predicted. In real estate alone, an estimated $5 billion may have been laundered in 2018 in the province. Money laundering from opioids made in the South of China has amounted to billions of dollars in BC alone, which has helped to make home ownership out of reach for most millennials. This is how Vancouver became the world’s laundromat for foreign organized crime. More unknowns will come out if we create an Excel sheet for people living in Vancouver renting exotic cars; living in mansions; flying on private jets; gambling at casinos with huge cash—at least 500 common denominator persons will qualify as high risk ones. Then CRA (Canada Revenue Agency) can check (instead of aiming the sword at people having hard-earned income) if their earning matches spending. Over $ 85 million in GST rebates were issued in 2018 to “luxury” car buyers who are purchasing $ 100, 000 + vehicles in cash or through “3rd parties” to launder drug proceeds as well.

Ontario-Target zone for human trafficking and horse racing

Human trafficking is taking human tolls on all of us. More than two-thirds of police-reported human trafficking violations in Canada occur inside the province. Toronto acted as a hub over past couple of years for a number of human trafficking routes. Now we come to Horse Racing business. This sector is vulnerable to money laundering, but not accountable to any regulatory body to monitor its operations for this type of crime. Although the horse racing industry is licensed, regulated and receives a significant amount of public funding, it lacks transparency and public accountability.

Illicit Cannabis Trading and celebrating 1 year of pot legalization

There are growing indications that the drug trade is increasingly moving to the dark web and crypto currencies. Youngsters are shopping for drugs on the so-called dark net, accessible not through traditional search engines but by way of special browsers and software that conceal IP addresses and make users harder to trace. These drug markets are clandestine dispensaries of illicit and dangerous substances that are sold in exchange for cryptocurrencies, such as bitcoin. They pose a challenging front in the fight against the opioid crisis for the law enforcing agencies. Time is ripe enough (on Financial Institutions’ part) to gain the visibility and expertise to mitigate risk exposure from this new asset class. Statistics say, illicit sales of cannabis alone would add around 0.4% to its GDP.

‘The Laundromat’: The movie

The movie ‘The Laundromat’ is about a big law firm called Mossack Fonseca that was based in Panama.90% of its clients were big law firms and accounting firms in Germany, Canada, Hong Kong, China, the UK who were asking them to create shell and shelf companies. Historically, gatekeepers have always remained at focal point because of such services. It is believed, one of China’s most Politically Exposed Persons ever, whose father has been given a life sentence in 2013 and is now in a Chinese prison (seems to have been featured in the movie ‘The Laundromat’), is working as a business analyst for a Canadian company with deep China ties.

Blockchain Technology: Unavoidable reality

Crypto assets have become pervasive in the financial industry across the globe to a surprising degree. Consequently, even banks that don’t think they have risk exposure, need early warnings and detection of bad actors operating in their networks and payment system. When we think about cryptocurrencies, we see, British Columbia based LifeLabs paid Bitcoin to hacker extorting them, which they are allowed to do only if exchange files an SAR (Suspicious Activity Reporting) on LifeLabs and hacker. It is high time to gain the visibility and expertise to mitigate risk exposure from this new asset class.

FINTRAC: Coming out of the image ‘toothless crime watchdog’

FINTRAC, being Canada’s financial intelligence unit, mandates to facilitate the detection, prevention and deterrence of money laundering and the financing of terrorist activities, while ensuring the protection of personal information under its control. Specifically, through introduction of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), FINTRAC aims to assist in fulfilling Canada’s international commitments to participate in the fight against transnational crime, particularly money laundering and the fight against terrorist activities. Recently, FINTRAC published certain changes to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and from now on FINTRAC is required to publicly name the reporting entity, the nature of its violation of the PCMLTFA, and the amount of the penalty imposed. FINTRAC is highly focusing on unregistered Money Service Businesses in Canada. FINTRAC’s investigation identified that cannabis dispensaries not federally licensed to produce and/or sell cannabis in Canada, used Moxipay (an Edmonton based Money Service Business, operating as an unregistered Money Service Business) to transfer and receive funds. FINTRAC provides intelligence on the money trail to law enforcement and the national security agencies—with information not readily available elsewhere. Where this information is not presented by reporting entities to FINTRAC in a form required, stiff penalties including making public all administrative monetary penalties (AMPs), can be imposed. These AMPs will range between $25,000 to $500,000 depending on the level of deficiencies. Organizations can, therefore, suffer irreparable reputational damage if found to be deficient in this regard.

Journey towards infinity : Are we ready ?

Money laundering in Canada is nearly impossible to quantify because, by nature, it’s hidden. However, Canada has fallen so far behind for so many years, it’s not that easy to catch-up. In terms of financial crime compliance in Canada, we are not doing bad nationally on anti-money laundering; not doing great on counter-terrorist financing. It’s critical to understand that the landscape is changing on two frontiers. One is the regulatory frontier, and the other is the environment in which we operate. Bad actors/wrongdoers are changing their ways every single day. Positive thing is, Canada’s regulatory authorities are much more concerned about this issue now. Better late than never. It’s heartening to note, tone from the top is already there. Ontario is investing $20M into fighting human trafficking. Steps have already been taken by the Federal and Provincial government to create mass awareness against this atrocity, a 24/7 Hotline has been launched to report any suspicious activities relating to human trafficking. As British Columbia begins to crack down on the washing of dirty money, failure to change and implement national laws will make the crime go elsewhere in the country. Let’s keep our fingers crossed and wait to see what lies ahead of us.

The author Ahsan Habib is currently working for Scotiabank, Canada as AML Analyst. He is a seasoned banker from Bangladesh where he worked in correspondent banking and foreign remittance department. Ahsan has CAMS accreditation from ACAMS. Apart from this, he has certification on Trade-Based Money Laundering from Canadian Securities Institute (CSI), certification on Sanction related various courses and certification on ‘BSA/AML: An In-Depth Look’ from Bank Administration Institute (BAI), USA. He is also vocal against Human Trafficking on various platforms.

Abdullah Al Mamun Reageren

Very critical insights covering key areas of concern, which from outside was unknown. Canada being a progressive country, we expect it will take timely measures before it becomes uncontrollable. Thanks to the author!

Ahsan Habib Reageren

Thanks, Sir, for your kind words. I agree to the core, Canada while being an example to the world in many aspects, specially for its outstanding efforts in climate change and humanitarian ground, needs to be more focussed in its fight against financial crimes. I’m pretty sure, in Canada, we can do that because tone at the top is already there.

Linda Reageren

Well done on an excellent article Ahsan. Unfortunately financial crime is a worldwide problem and we need better measures to detect, and report. Criminals and terrorists are very innovative, unfortunately our legislation worldwide not always so.

Ahsan Habib Reageren

Thanks Linda, I’m happy to see, you found my article interesting. Going back to your comments, I would add, Money Laundering is not just an abuse of financial systems; it is an abuse of citizens and their basic human rights. After 9/11, most money laundering and terrorist financing activities have been done through shadow banking systems, blockchains etc. When I moved to Canada couple of years back, from my native country Bangladesh, AML was merely a mainstream job there. Now Bangladesh has no Non-Compliant (NC) rating in AML Global Standard whereas Canada has few NC ratings which is not expected. Silver lining is, Canada’s financial crime watchdog is proactive now and they realized, late responses to warnings may worsen the situation.

Ahsan Habib Reageren

Another thing, I’d like to add, Linda, in today’s financial world, having an effective AML program is no more a choice for any FI (it’s also a competitive advantage for them) because environmental, social, and governance issues matter more today than ever. Sharp but soft power sets the stage and enables systemic corruption and leverage through Threat Finance. Hybrid warfare utilizes transnational organized crime to undermine financial institutions from the inside. HSBC in the US already faced that.

Consuelo DiGuglielmo Reageren

Great article thoroughly covering the gloomy outlook of Canada’s Money Laundering regulations and applicability. The link with other economic crimes is well conveyed.

Congratulations Agsan!

AHSAN HABIB Reageren

Thanks Consuelo, for your observation. Actually it’s the gloomy outlook of entire world’s AML regulations and implementation. You see, IMF has recently decided to have a close look on Nordiac banks. Good thing with Canada is, the country is not on the FATF List of Countries that have been identified as having strategic AML deficiencies. Therefore, I’d say, the Financial Crime Watchdog of Canada made a timely move to put control on the issues that could pose great challenges in coming days.

Vladimir Kalinov Reageren

Great article and very eye-opening!

AHSAN HABIB Reageren

Thanks Vladimir, I’m happy to see, you found it interesting….