Prior to the outbreak of the COVID-19 virus, large active banks operating on an international scale made more progress towards satisfying the Basel III capital requirements. Their liquidity ratios remained stable in comparison to the ratios reported in the end of 2018, but there is a need to increase the operational capacity of banks and supervisors to adequately respond to the pandemic. The Basel Committee has made a decision to not collect Basel III monitoring data for the end June 2020 reporting date set.

The Basel Committee has published the outcomes of its recent Basel III monitoring exercise that it carried out, which is based on data obtained from the 30th of June 2019. In its report, they outline the impact of the Basel III framework that was agreed upon initially back in 2010. It also discusses the effects of the Basel Committee’s December 2017 finalising of the Basel III reforms and the finalising of the market risk framework that was published in January 2019. With regards to the June 2019 reporting date, the results that were published do not reflect the economic impact of the coronavirus on the participating banks.

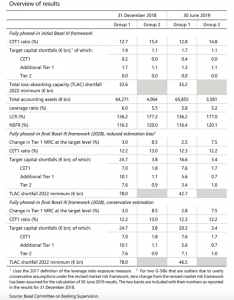

Regardless, the Basel Committee maintains that the results given in the report will provide the relevant stakeholders with a useful benchmark for analysis. The data provided in the report is for 174 banks, including 105 internationally large active banks. These banks, labelled in the report as “Group 1”, are characterised as large banks operating on an international level that possess Tier 1 capital of greater than €3 billion, which includes all 30 institutions that have been assigned as global systemically important banks (G-SIBs).

The report also addresses a second group of banks, labelled as “Group 2”, which includes 69 banks that have Tier 1 capital of less than €3 billion or do not operate actively in an international setting. A recent agreement has been reached by the Group of Governors and Heads of Supervision that the implementation of the final Basel III minimum requirements has been postponed to January 1 2023, and they will be fully in effect by January 1 2028.

The impact on average of the fully phased in final Basel III framework on the Tier 1 minimum required capital (MRC) of Group 1 banks is lower at a 2.5 percent increase when compared with the 3.0 percent increase at the end of December 2018 (see the ‘reduced estimation bias’ section of the table shown below). For this particular calculation, for two global systemically important banks that are outliers because of incredibly conservative assumptions made under the revised market risk framework, no change from this framework has been assumed in the results of the June 30th 2019 calculation.

However, if these two banks are assumed with their conservative market risk numbers (refer to the “conservative estimation’ in the table), there is a noted 2.8 percent increase. When it comes to the capital shortfalls reported at the end June 2019 date, it was at €16.6 billion for Group 1 banks at the target level with reduced estimation bias, and €20.3 billion with conservative estimation when compared with the €24.7 billion reported at the end of December 2018.

The results of the Basel Committee’s Basel III monitoring exercises also take into account bank data on Basel III’s liquidity prerequisites. The weighted average Liquidity Coverage Ratio (LCR) was shown as stable at 136 percent for Group 1 banks and at 177 percent for the Group 2 banks. All banks included in the sample results reported an LCR that either met or exceeded 100 percent. The weighted average Net Stable Funding Ratio (NSFR) maintained stability at 116 percent for the Group 1 bank sample and at 120 percent for the Group 2 banks.

As of June 2019, about 96 percent of the banks included in the NSFR sample reported a ratio of exactly 100 percent or exceeding it while all banks reported a NSFR at or exceeding 90 percent. In order to give greater operational capacity for banks and supervisors to take action to the immediate financial stability priorities that came about as a direct result of the impact of COVID-19, the Basel Committee has made a decision to not collect Basel III monitoring data for the end June 2020 reporting date. This, therefore, means that they will not publish a report in the spring of 2021. However, they are aiming towards publishing the coming Basel III monitoring report on end December 2019 data in autumn 2020.

The table below shows an overview of the data and results that was collected and found from the Basel III monitoring exercise based on data from the 30th of June 2019 reporting date.

Source: the Bank for International Settlements (BIS)