Gone are the days when organisations could simply promise a speak up culture. Today, fostering a culture of trust, integrity, and a positive work environment…

Download whitepaperChange is happening now – let’s make the most of it

The changing business and risk landscape, the implications of the fourth industrial revolution for members and how Airmic can help them flourish in the new environment formed the backbone annual conference. More than 1,800 people attended the event including nearly 500 members. The conference saw the unveiling of more than ten reports and papers, ranging from cyber-governance to parametric insurance to an analysis of the impact of the Insurance Act.

Continue reading…

British Foreign Secretary Boris Johnson resigns over Brexit Discord

British Foreign Minister Boris Johnson resigned! Former mayor of London and the front man of persuading Britons to quit the European Union. That has been announced by the office of Prime Minister Theresa May. His departure follows the earlier departure of David Davis, who was in charge of the Brexit File, from the May cabinet.

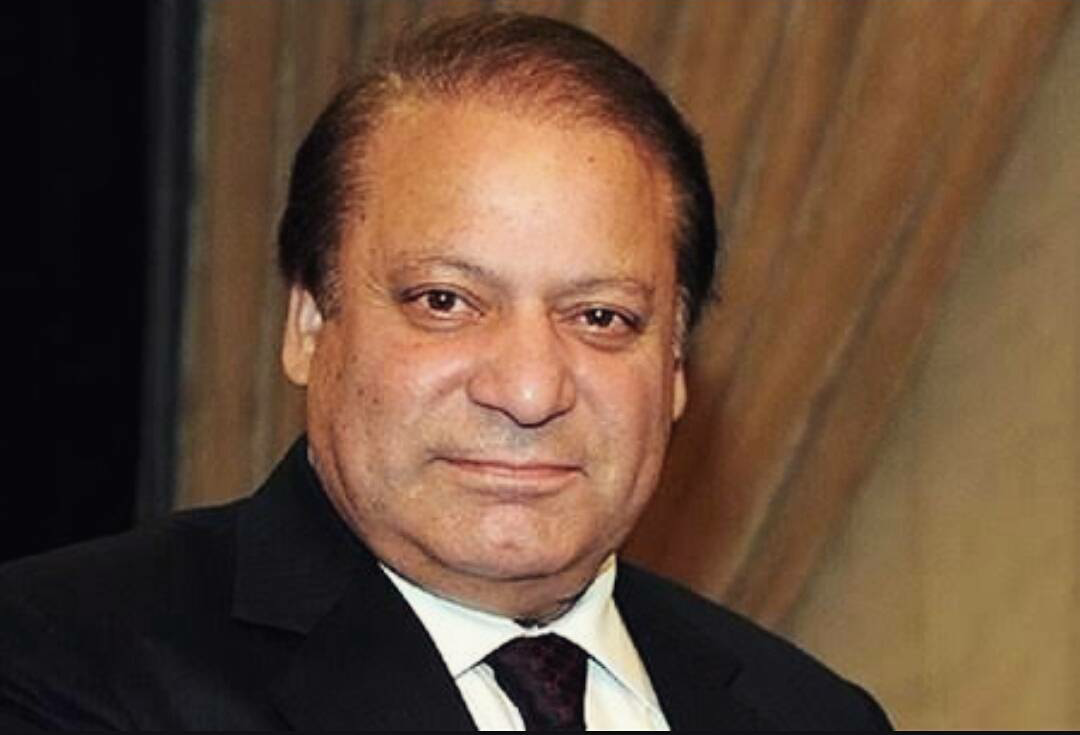

Corruption let to 10 years jail for former Pakistani PM Nawaz Sharif

Former Pakistan Prime Minister Nawaz Sharif has been sentenced to 10 years in prison and fined $10.6 million on corruption charges linked to 2016 Panama Papers revelations about his family’s properties overseas. Continue reading…

Building an Ethical Culture is the book for compliance and ethics professionals who want to understand what fuels unethical behavior in the workplace and how …

EBA assesses risks and opportunities from Fintech and its impact on incumbents business models

The European Banking Authority (EBA) published the first products of its FinTech Roadmap, namely (i) a thematic report on the impact of FinTech on incumbent credit institutions’ business models and (ii) a thematic report on the prudential risks and opportunities arising for institutions from FinTech. Both reports fall under the wider context of the newly established EBA FinTech Knowledge Hub and aim to raise awareness within the supervisory community and the industry on potential prudential risks and opportunities from current and potential FinTech applications and understand the main trends that could impact incumbents’ business models and pose potential challenges to their sustainability.

Continue reading…

FCA proposes new Directory of financial services workers

The Financial Conduct Authority (FCA) has proposed a new Directory to help consumers and firms check the status and history of individuals working in financial services. The Directory will include all those who hold Senior Manager positions requiring FCA approval and those whose roles require firms to certify that they are fit and proper. This includes those in consumer-facing roles, such as mortgage and investment advisers.

Continue reading…

FCA reveals the fourth round of successful firms in its regulatory sandbox

The Financial Conduct Authority (FCA) announces the 29 firms that were successful in their applications to begin testing in the fourth cohort of the sandbox. The regulatory sandbox allows firms to test innovative products, services or business models in a live market environment, while ensuring that appropriate protections are in place. It is part of Innovate, an initiative kicked off in 2014 to promote competition in the interest of consumers. Since its inception Innovate has had over 1200 applications and has supported more than 500 firms. The sandbox was a first for regulators worldwide, underlining the FCA’s commitment to innovation in financial services.

Continue reading…

Regulators extend the next resolution plan filing deadline for 14 domestic firms

The Federal Reserve Board and the Federal Deposit Insurance Corporation announced that they have extended the next resolution plan filing deadline for 14 domestic firms by one year to December 31, 2019, to allow additional time for the agencies to provide feedback to the firms on their last submissions and for the firms to produce their next plan submissions.

Continue reading…

Market developments and vulnerabilities

The Plenary discussed, as part of its regular risk assessment, market developments and vulnerabilities in the global financial system. The Plenary continues to see a broad-based snap-back in long-term interest rates as a risk. After a decade of very low interest rates, financial institutions and markets in advanced and emerging market economies may not be sufficiently prepared for potential adverse economic and financial risks from market developments. A tightening of financial conditions could stem from surprises in economic growth, inflation, expectations of monetary and fiscal policies, or geopolitical events.

Continue reading…

POLITICAL RISK investigates and analyzes this evolving landscape, what businesses can do to navigate it, and what all of us can learn about how to …

Continue reading…