by Ahsan Habib

Almost all major crimes ultimately lead to money laundering. Human trafficking, tax evasion, Ponzi schemes, kleptocracy/political corruption, drug/weapon/organ smuggling, green crimes, terrorist resourcing and what not. These offences have a name in common i.e. Predicate Offences. Twenty two predicate offences have already been identified by the European Union, and there may be more to come as wrongdoers have always been innovative. Corruption is the five-alarm fire raging in almost all jurisdictions. This offence has always existed but never has it been this out of control.

Predicate offences and Money Laundering – Chicken or egg story?

Money laundering cannot exist in its own right. Rather, it enjoys a relationship with the original offence, without which money laundering would not be necessary. In many instances, it is the secondary activity of Transnational Organised Crime. Let’s revisit 1930-ish. So many years have passed since the American gangster Al Capone had been convicted of tax evasion, he owed $200,000 in back taxes, and was sentenced to 11 years of imprisonment1. His income was mainly derived from his gambling establishments, houses of prostitution and bootlegging. The practice of hiding source and commingled funds (licit and illicit) predates Al Capone era, and the ‘Money Laundering’ itself post dates Capone. From that perspective, Capone had nothing to do with the term ‘Money Laundering’. Unfortunately, even after 74 years of Capone’s death, knowingly or unknowingly, often times we blame him for giving birth to the term ‘Money Laundering’. Je suis désolé, Capone, hope you are keeping well. We, the financial crime fighters, are also doing well, just bringing our whole selves to the fincrime space as we are collectively adjusting to new typologies.

Cyber Threat Intelligence: Top of mind

Cyber threats seem to have become a permanent threat to society: we are hardly alone in that. More than ever, risk management teams need to consider industry standards. People can be the asset or the liability when it comes to cyber security. Did we ever think, online/internet games could be used to perform financial crimes? Not many years back, online entertainment department of Sony Group Corporation found that one of its customers transferred large amount of money from a US account to a Russian account by playing games using virtual assets.

Ever evolving typologies, starting from drug trafficking

Combating financially motivated crimes is not all about money. It’s also about saving human lives from drugs, from being victim to gun violence/war crimes, from modern day slavery/online child exploitation, and green crimes. With the significant expansion of the predicate offences list and innovations in products, financial institutions (FIs) have leaned towards Risk Based Approach (RBA) so that they may assess their own risks and decide which customers they are going to onboard and serve. Will they continue to recognise PEPs as high risk clients without categorisation? PEPs who have been mentioned in the recently exposed Pandora Papers, are already in a grey area in terms of risk factors. Reputationally Exposed Persons (REPs) are also provoking thoughts or raising eyebrows when we see news on a Miami professor who has been said to remain behind bars for laundering dirty Venezuelan money2. Perhaps in the future, Rule Based Approach would seem more feasible to FIs while combining human intelligence with artificial intelligence.

Money laundering through social media: Much more than speed bumps

Bad actors have always been creative. If they would have used their talents for the sake of humanity, the planet could be benefited. But they decided to go otherwise. They are convincing vulnerable and young people often on Instagram and Snapchat to let them use their bank accounts for illicit fund flow. Sugar daddy scammers are active on this space and twitter. May be these happenings are still underreported but are increasingly demanding our focus on money mules3. Not too many years ago, Silk Road was an online marketplace, being recognised as the “Amazon for drugs” — where unmapped people could buy and sell things anonymously, free from the barriers of the state.

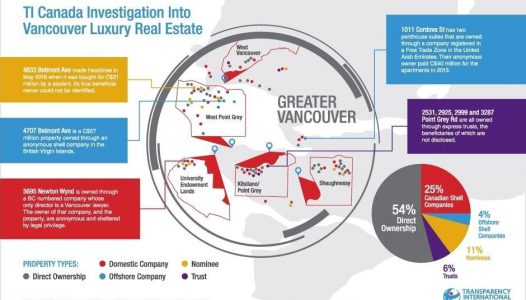

Question of the Ultimate Beneficial Ownership reignited

When the owner of a property needs to prove the provenance of funds used to pay for it and they cannot, they should be going through Unexplained Wealth Orders (UWO) and the property may be seized and sold. UWO may work better than Beneficial Ownership Registry when it comes to combating money laundering through real estate, art and antiquities and other such properties. However, it’s my thoughts only. UK has already started getting benefits of UWOs in making the actual recovery of the alleged proceeds of crime4.

Establishing accountability of enablers: Alter, Control or Delete?

Gatekeepers like lawyers/attorneys, realtors are called so because they are ‘Guardians at the Gate’ and are supposed to carry a level of responsibility and share financial intelligence. By the same token, they are vulnerable to corrupting influences or have been historically misused by money launderers and criminals. Historically, gatekeepers have always remained a focal point because of services like creating shell/shelf companies. In many jurisdictions, accountant and attorneys have no suspicious activity reporting requirements of their own. Unfortunately, implementation of the standards and regulations around enablers is getting delayed amid protests from the aforesaid groups. I am closely observing the progress on the ‘The Enablers Act’ which was introduced in the US Congress in October 2021. It is a kind of odd and puzzling why the standard setting around gatekeepers is taking time or getting paused.

Crypto and Blockchain: Opportunities and/or challenges

There is a saying: prevent small fails before it turns into mass failures. Virtual assets are not fads. I am not considering it as Bella Ciao to fiats but crypto and Blockchain are the futures. Countries may risk losing out on economic opportunities if regulators and governments are too hesitant about embracing this new technology. But careful and strict regulations need to be set up around Blockchain, crypto assets, Non Fungible Tokens (NFTs), Fan Tokens. Organised crime groups are converting illicit proceeds in the form of virtual currencies. New money laundering techniques are relying on cryptocurrencies and it involves use of mixing services and coin swappers5. If we fail to place effective standards all round, this small failure may lead to disaster. Thousands of tradeable cryptocurrencies are available to average consumers, but customer due diligence requires filtering through mountains of open-source information.

In the Weeds: Of the people, by the people, for the people

The big risk in banking hemp or Cannabis companies is they do not follow all legal requirements, such as having the correct licenses and registrations, or they grow the hemp in a tract of land that has not been approved. With cash-oriented Marijuana Related Businesses (MRB), financial institutions face the real risk of legal action for money laundering and aiding in drug trafficking. Some MRBs may commit fraud or open up shell companies just to gain access to the services of a financial institution. For example, an MRB may list itself as a “pharmacy”, “nursery” or “wellness center” in order to get through the onboarding process.

The Maxwell Trial: Sex Trafficking Zoomed in

The France-born, British influential person Ghislaine Maxwell was convicted of five federal sex trafficking charges after a jury concluded that she played a pivotal role in recruiting and grooming teenage girls to be sexually abused by her close confidant6. My kudos to the bravery of the girls — now grown women — who stepped out of the shadows and entered the courtroom. It is said, the billionaire’s private paradise in US Virgin Islands was centre of international sex trafficking ring.

Environmental crime in the spotlight

The issue of environmental crime has already been brought to the top of the financial crime agenda and efforts to tackle illicit money associated with financial crime are connected to the wider issue of climate change. The FATF has broken the fight against green crime down into two core components: how firms can assess their exposure, and how public and private sector organisations can combat the threat itself. Far too often, bad actors and their associates are well able to get away with environmental crimes, they are making billions from looting our planet.

Punchline: The rising tide will lift all boats

There is a popular, old saying that roams around the compliance space: ‘In theory there is no difference between theory and practice, but in practice…(dear readers, please fill in the rest)’. Walking our talks once again comes into focus. Collaboration between stakeholders like law enforcement agencies, regulators and private sectors (that covers all financial institutions/Fintechs) has no alternative. I know, these magical words are being uttered so often now a days, that it is not unlikely that we may get tired of listening these words. But en fin de journée, collaboration is the thing that we must seize the opportunity to use at an optimum level. Artificial Intelligence will not spell the death of compliance roles. AFC professionals will still be required to run the softwares/solutions and to lend their expertise while detecting ever-evolving Money Laundering techniques.

The views/thoughts expressed in this article is that of the author’s and does not represent his organisation’s policies and standing’.

The author Ahsan Habib is currently working in a leading bank in Canada in AML Operations Governance team. He is a seasoned banker (with 10+ years’ experience) from Bangladesh where he worked in correspondent banking and the cross-border remittance department. Being an anti FinCrime (AFC) subject matter enthusiast, he is vocal against greed driven crimes like Human Trafficking, Child Sexual Exploitation, Corruption, Elder Financial Exploitation. Recipient of two recognitions from ACAMS as professional of the year and professional of month, Ahsan’s notable number of articles have been published from North America and Europe (few published by Risk & Compliance Platform Europe where he is a regular contributor).

*(3) https://www.34st.com/article/2020/11/sugar-daddy-mommy-baby-scam-instagram-twitter

*(4) https://www.lexology.com/library/detail.aspx?g=8dec9260-f036-4da9-8737-bf4d51f7cac6

*(5) https://threatpost.com/organized-cybercrime-syndicates-europol/176326/

Cesar contreras Reageren

Excellent perspective!

Ahsan Habib Reageren

Thanks, Cesar. Glad to hear that you found it worth reading.