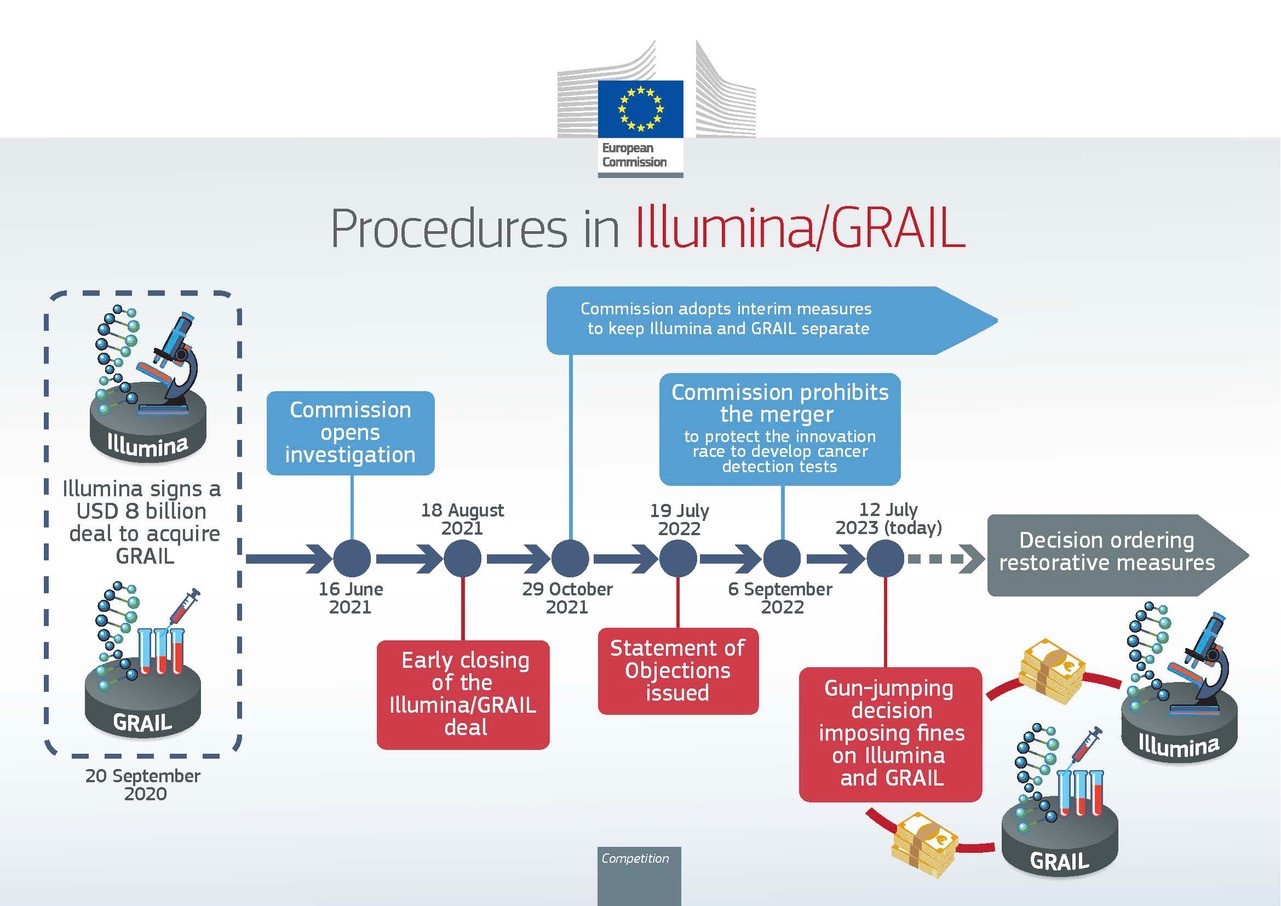

The European Commission has fined Illumina and GRAIL approximately €432 million and €1,000 respectively, for implementing their proposed merger before approval by the Commission, in breach of EU merger control rules. EU merger rules require that merging companies not to implement mergers until approved by the Commission (“the standstill obligation”). It is a cornerstone of the European merger control system, that enables the Commission to carry-out its role before structural changes modify the competitive landscape. In July 2021, the Commission opened an in-depth investigation into Illumina’s acquisition of GRAIL. In September 2022, the Commission blocked the transaction over concerns that it would have significant anticompetitive effects, stifling innovation and reducing choice in the emerging market for blood-based early cancer detection tests. In August 2021, however, while the Commission’s review was still ongoing, Illumina publicly announced that it had completed its acquisition of GRAIL.

On this date, the parties executed all documents needed to complete the transaction. Moreover, GRAIL merged with two wholly-owned subsidiaries of Illumina. The latter also paid GRAIL’s shareholders for their shares. In July 2022, the Commission sent Illumina and GRAIL a Statement of Objections finding on a preliminary basis that they breached the EU Merger Regulation by implementing their tie-up prior to the conclusion of the Commission’s in-depth investigation.

In today’s decision, the Commission confirms its preliminary view that Illumina and GRAIL intentionally breached the standstill obligation. The Commission found that by closing the transaction Illumina was able to exercise a decisive influence over GRAIL and it actually exercised it.

The fines

According to the EU Merger Regulation (‘EUMR’), the Commission can impose fines of up to 10% of the aggregated turnover of companies, which intentionally or negligently breach the standstill obligation. In setting the amount of the fines, the Commission considers the gravity of the infringement as well as the existence of mitigating or aggravating circumstances. The fine must also ensure a sufficiently dissuasive and deterrent effect.

Illumina and GRAIL knowingly and intentionally breached the standstill obligation during the Commission’s in-depth investigation. This is an unprecedented and very serious infringement undermining the effective functioning of the EU merger control system. In particular, the Commission found that:

Illumina strategically weighed up the risk of a gun-jumping fine against the risk of having to pay a high break-up fee if it failed to takeover GRAIL. It also considered the potential profits it could obtain by jumping the gun, even if it were ultimately forced to divest GRAIL. It then intentionally decided to proceed and to close the deal while the Commission was still investigating the transaction that was ultimately prohibited. This is a very serious infringement, which requires the imposition of a proportionate fine, with the aim of deterring such conduct. In setting such a fine, the Commission considered Illumina’s deliberate strategy, and took due account of the hold separate measures adopted by the company as a mitigating circumstance. The Commission is however subject to a statutory limit of 10% of Illumina’s turnover, i.e. approximately €432 million, and thus ultimately imposed this amount as a fine.

GRAIL was fully aware of the standstill obligation and yet played an active role in the infringement. For example, GRAIL took legal steps to enable the completion of the transaction, while it knew the Commission’s in-depth review was ongoing. The Commission has however decided to impose only a symbolic fine of €1,000 on GRAIL as this is the first time it imposes a fine for gun-jumping on a target company.

The Illumina/GRAIL merger case

Following a referral request from six Member States, on 19 April 2021 the Commission accepted to review the proposed acquisition of GRAIL by Illumina and opened an in-depth investigation on 22 July 2021. On 13 July 2022, the General Court confirmed the Commission’s jurisdiction to review the transaction.

While the Commission’s in-depth investigation was still ongoing, Illumina publicly announced that it had completed its acquisition of GRAIL. As a result, on 29 October 2021, the Commission adopted interim measures to ensure that Illumina and GRAIL would remain separate pending the outcome of the Commission’s merger investigation.

On 6 September 2022, the Commission prohibited the implemented acquisition of GRAIL by Illumina. Following the prohibition decision, the Commission renewed and adjusted the interim measures on 28 October 2022.

Furthermore, on 5 December 2022, the Commission sent a Statement of Objections to Illumina and GRAIL informing them of the restorative measures it intends to adopt. These would require Illumina to unwind the acquisition of GRAIL to give the Commission’s prohibition decision its full effect. A final decision concerning the unwinding of the deal is pending.

Margrethe Vestager, Executive Vice-President in charge of competition policy : “If companies merge before our clearance, they breach our rules. Illumina and GRAIL knowingly and deliberately did so by implementing their tie-up as we were still investigating. Today’s decision to fine both companies, for a total amount of €432 million, shows that this is a very serious infringement.”

Procedural background

The obligation on companies to notify the Commission of concentrations that have an EU dimension prior to their implementation is laid out in Article 4(1) of the EUMR. The standstill obligation, which is set out in Article 7(1) of the EUMR, establishes that concentrations with an EU dimension may not be implemented prior to notification to or clearance by the Commission. This obligation prevents the potentially irreparable negative impact of transactions on the competitive structure of the market, pending the outcome of the Commission investigation. The Commission considers any breach of the standstill obligation be a very serious infringement, as it undermines the effective functioning of the EU merger control system.

The ability of the Commission to impose fines in the event of a breach of Articles 4(1) or 7(1) is laid out in Article 14(2) (a) and (b) of the EUMR.