by Michel Klompmaker

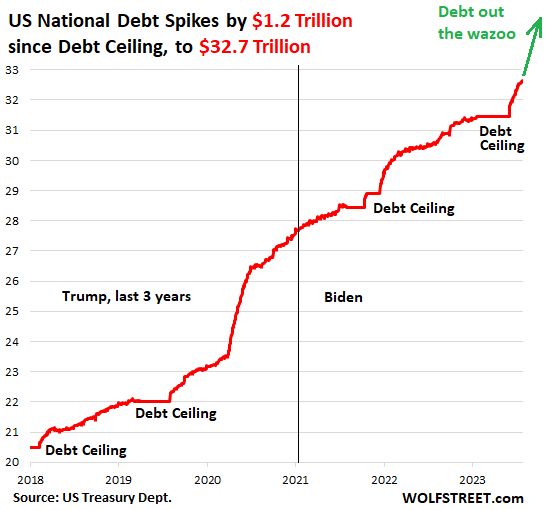

We recently spoke with Twan Houben about the possible impact of the enormously increased national debt in the United States. Twan Houben is concerned with crisis management, hence his special interest in the phenomenon of national debt on the other side of the Ocean. Then what’s going on? According to Marketwatch, the national debt there currently amounts to 33 trillion US dollars. To put that number into perspective, three years ago that was 23 trillion US dollars. It is not rocket science to calculate that with the increased interest rates in the last period, serious problems can arise if new loans have to be taken out to finance the national debt. But what are the consequences in Europe?

Dear Twan, back to the recent past. What exactly was the deal with the American national debt?

Twan Houben: “Look, we have now, in September 2023, reached a level of 33 trillion US dollars. Please note that these are trillions and not billions, in other words 1 trillion = 1,000 billion = 1,000,000 million. About three years ago that was about 10 trillion US dollars less. Over the past three years, former President Donald Trump has showered approximately $5 trillion in “helicopter money” on unemployed American citizens during the corona year of 2020. The same amount was used by his successor Joe Biden to fund the American Green Deal, later renamed the Inflation Reduction Act. As mentioned, they now have a national debt of 33 trillion US dollars. The big problem is that no less than 7.6 trillion US dollars will have to be repaid in the coming year and that is practically impossible.”

So that doesn’t look very nice, to say the least…

Twan Houben: “That is indeed expressed very cautiously, but perhaps you mean it a bit cynically. I prefer to talk about a catastrophe that is coming. The US debt ceiling was raised no less than four times in this three-year period. The problem is that the United States cannot meet the required $7.6 trillion in repayments in the coming year from current resources. The total tax revenue of the US was “only” 4.9 trillion US dollars in 2022. This means that we will have to borrow again to pay off existing debts. Borrowed at an interest rate that is approximately three times higher than that of the government loans to be repaid. That is precisely where their pain lies.”

That is obvious. But where do you think that’s going?

Twan Houben: “I like to make the comparison with a simple example of your own house. Imagine; you have no money to pay off your own mortgage and you go to another bank with the request for a new mortgage at a three times higher interest rate to pay off your old mortgage. Do you see that happening on a micro level? Well, we now see that the United States will have to look for money and take out new loans, but they will have to do so at increasingly higher interest rates, which will further erode confidence in the dollar. This in turn translates into lower credit ratings and increasingly rising credit costs. Until a time when this is no longer sustainable and the United States finds itself in a similar situation to Greece in the recent past.”

What will we notice about this in Europe?

Twan Houben: “We will certainly notice that here in our economy. It is therefore high time for Europe to become more economically independent of the United States and to look for other “friends” on the world stage. My conclusion is that due to the completely out of control national debt in the United States, the next global crisis is very close.”

Any final comments?

Twan Houben: “It is really in the interest of both Americans and Europeans that neither Donald Trump nor an elderly Joe Biden will return to the White House after the upcoming American presidential elections.”